Health Care Flexible Spending Account

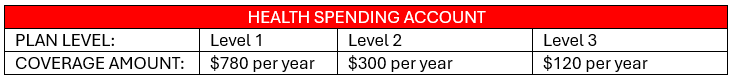

HSA Coverage

Note: this is a shared account for all insured individuals on a certificate (i.e. the account amount is per family, not per person)

Carry-Forward Policy

Our HSA has a one-year carry-forward policy. This means that if you don’t use your full HSA balance by December 31 of a given plan year, it will be carried forward to the next year. If you don’t spend that carryover by the end of year two, you lose it!

Note: AGA offers a 60-day period at the beginning of the year to submit HSA claims for expenses incurred in the previous year. After this grace period, no claims from the previous year can be reimbursed under the HSA, and the remaining amount will be used for claims incurred in the current year.

Eligible Expenses

Eligibility is based on whether the expense is categorized as a valid “medical expense” in accordance with Canada Revenue Agency (CRA) regulations. You can view a complete list of eligible expenses on the CRA Website.

Eligible Dependents

You HSA can also be used for expenses for an expanded list of dependents, not just those eligible for coverage under your Health & Dental plan (i.e. spouse, children).

This includes grandchildren, parents, grandparents, siblings, aunts, uncles, nieces and nephews of you or your spouse, if the following applies:

They are dependent on you for financial support and are claimed as a dependent on your tax return.

They have lived in Canada at some point during the calendar year (not a requirement for spouse, children, or grandchildren)