.png&w=3840&q=75)

Retirement & Pension

Planning for retirement is an important part of your financial wellbeing. Samuel’s Defined Contribution Pension Plan (DCPP) is designed to help you save for the future through contributions, flexible investment options, and helpful tools to guide your decisions.

Our DCPP gives you the opportunity to improve your financial health over time based on:

- • Your personal short- and long-term financial goals.

- • A variety of funds with different levels of risk to match your investing style.

- • Monitoring and updating your investment strategy to address your changing needs and circumstances.

Contributions

Your pension plan is funded through contributions from both you and Samuel.

Employee Contributions

→ You can choose to contribute 3% to 5%, and have the option to make your regular contribution in increments of 0.5%.

→ Regular Contribution Amount Options: 3%, 3.5%, 4%, 4.5%, 5%

→ Contributions are deducted automatically from your pay.

→ If you wish to contribute more than 5% to your DCPP, you can do so through setting a voluntary contribution amount. Voluntary contribution amounts are NOT matched by Samuel.

Employer Contributions

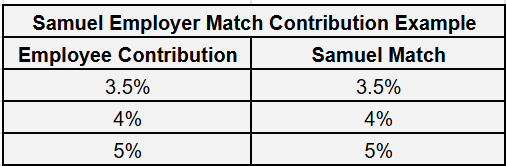

→ Samuel will match your regular contribution percentage, to a maximum of 5%.

→ Example: If you want to contribute 7% of your earnings* per year towards your DCPP, enroll your Regular contribution at 5% and your Voluntary contribution at 2%. The company will contribute 5%.

Changes to Your Contributions

→ Basic and voluntary contribution amounts can be changed at any time, and changes will take effect on the first day of the following month. You can change your investment selection(s) once every 30 days. Any additional changes to your investment will be charged a set fee.

→ Only voluntary (unmatched) contributions are permitted to be withdrawn or transferred to another savings account. You can make one free withdrawal/transfer per year. Each subsequent withdrawal/transfer will cost $25.

→ Note: Mandatory minimum contribution of 3% of your earnings* per year required.

*Earnings = salary/wages, overtime and vacation pay, and commission (if applicable).

Investment Options

You have control over how your pension savings are invested. We offer a variety of investment options to best match your preferences. Available investment strategies range from conservative to aggressive mixes, in the following categories:

Cash Equivalents

Bonds (Fixed Income)

Canadian Equity

U.S. Equity

International Equity

To view investment options, log-in to your Sun Life account.

When inputting a voluntary contribution amount, indicate the percentage of earnings you wish to contribute in addition to your regular contribution.

NOTE: If you do not select an investment mix, your DCPP contribution will be invested in the default investment option, the BLK LP index fund, that matures closest to, without going past, your 65th birthday. This is a balanced fund that adjusts its asset allocations to become more conservative over time, so that you have lower risk as you approach retirement.

In accordance with the Income Tax Act (Canada), the total of all contributions (inclusive of company contributions) made to your DCPP in a year cannot exceed the lesser of 18% of your total compensation from Samuel Son & Co., and the money purchase limit, as defined under the Income Tax Act (Canada), for that year.

Helpful Tools

Sun Life has a variety of self-guided tools that you can use to help make decisions regarding your retirement and pension savings choices.

Asset Allocation Tool

Understand your investment personality – discover your risk tolerance and find the right investment mix.

Retirement Savings Planner

Determine how much money you’ll need to retire based on your desired retirement lifestyle.

Fund Performance Reports

Review the performance of your investments, the historical performance of all available funds, and associated fund management fees (FMF)

Simple Put Playlist

Watch a collection of short videos by Sun Life about various financial topics.